Posted in市場趨勢

2026 年光通訊產業研究:AI 資本支出浪潮下投資策略怎麼選

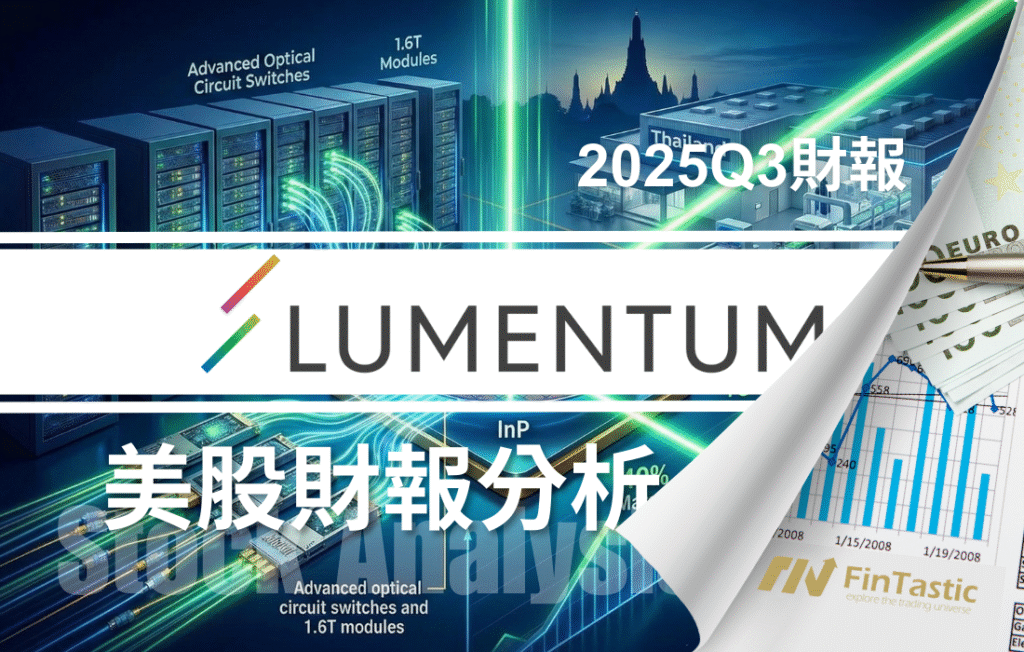

2026 年 AI 資本支出聚焦傳輸效率,銅線瓶頸推動產業確立「短距用銅、長距用光」架構,。投資邏輯鎖定 800G/1.6T 升級潮,價值鏈由模組廠向上游轉移,。市場首選掌握磷化銦(InP)等稀缺材料的垂直整合 IDM 廠(如 Lumentum、Coherent),以及定義規格的平台商,。技術關注矽光子與 CPO 發展,而 Retimer 則為銅線過渡期關鍵,。資金青睞具高技術門檻的寡頭勝過紅海競爭者。